Distributed Ledger Technology (DLT) can sound intimidating, but it’s really just a digital database that multiple participants share and manage together. Unlike traditional ledgers stored in a single place, DLT copies are distributed across many computers, ensuring transparency, security, and decentralization.

What Exactly Is a Distributed Ledger?

A distributed ledger is a shared database spread across multiple locations or participants. Unlike traditional systems managed by a single authority (like a bank or central server), there’s no single owner. Every node in the network holds a copy and stays synchronized through a consensus mechanism—everyone agrees on what’s valid before any update happens.

This setup makes tampering nearly impossible. If one copy is altered or lost, the others remain intact. Security comes from cryptography—each transaction is signed and often linked to the previous one, so any changes are instantly noticeable. The result is a trusted, tamper-evident record without needing a middleman.

While the concept has been around for decades, distributed ledgers hit the mainstream with blockchain’s debut in 2009. Bitcoin proved strangers could maintain a shared ledger securely over the internet. That changed everything. If a distributed ledger could work for money, people wondered, why not for assets, supply chains, or even identities?

Today, DLT is proving it can do exactly that—offering a new way to build trust in a digital world.

But as we’ll see, blockchain is just the beginning of the DLT story. Let’s start with blockchain – the original DLT superstar – and then explore the other types of distributed ledgers that have emerged.

Blockchain: DLT’s First Superstar

When people think of DLT, blockchain usually comes to mind. Popularized by Bitcoin, blockchain stores transactions in blocks that link together like a chain. Once a block is added, it’s nearly impossible to alter without rewriting every subsequent block—ensuring tamper resistance and transparency. Every node has a copy, so any inconsistencies are quickly rejected.

Blockchain’s defining traits—immutability, decentralization, and consensus—made it revolutionary. It enabled digital money, smart contracts, and trustless systems without middlemen. This success sparked interest across industries, from finance to logistics.

Over time, different blockchain models emerged:

- Public Blockchains like Bitcoin or Ethereum are open to all. They’re decentralized and censorship-resistant but can be slow and energy-intensive.

- Private Blockchains restrict participation to known entities—faster and more efficient but less decentralized.

- Permissioned Blockchains control who can validate transactions. Some, like SeaSeed Network, are public to use but have permissioned validators, combining openness with regulatory compliance.

Despite ongoing challenges—like scalability and fees—blockchain has moved from a niche invention to a strategic technology. And its evolution has inspired a new wave of DLT designs focused on speed, scale, and specialization.

Beyond Blockchain: Other Types of DLT

Blockchain may have pioneered distributed ledgers, but it’s not the only game in town. Alternative DLT architectures like DAGs, Hashgraph, and Holochain aim to fix blockchain’s pain points—scalability, speed, and energy use—by rethinking how ledgers work.

Directed Acyclic Graph (DAG): A Web of Transactions

DAGs trade blockchain’s chain-of-blocks model for a web of interconnected transactions. New entries confirm previous ones, growing a graph without the need for blocks or miners. This parallel processing makes DAGs fast and scalable—perfect for high-volume, low-value uses like IoT.

IOTA’s “Tangle” is a prime DAG example. It processes feeless microtransactions by having each device verify two others. No miners, no fees—just lightweight validation. Nano uses a similar structure called a block lattice.

However, DAGs tend to be less decentralized or mature than blockchains. IOTA, for instance, once relied on a central “Coordinator” to prevent attacks. Security also depends on transaction volume: low activity can reduce reliability.

Hashgraph: Gossip with a Purpose

Hashgraph uses a “gossip about gossip” mechanism to share transactions and build consensus. Instead of mining, nodes share data and its origin, enabling virtual voting. The result: fast, fair, and secure ordering without energy waste.

Hedera Hashgraph boasts high throughput and finality in seconds, making it attractive for enterprise use—think finance, supply chains, and payments. Its governance model includes a council of major firms like Google and IBM.

Still, Hashgraph isn’t open-source and is more centralized than public blockchains, leading to debates about its level of decentralization.

Holochain: Everyone Runs Their Own Ledger

Holochain breaks the mold completely. Instead of one global ledger, each user keeps their own chain. Transactions are validated peer-to-peer using a distributed hash table. There’s no global consensus, which means massive scalability and energy efficiency.

It’s ideal for apps like social platforms or supply chains where users share and validate data locally. But Holochain isn’t great for global currencies—there’s no unified ledger to track balances. It’s better thought of as a framework for decentralized apps than a ledger.

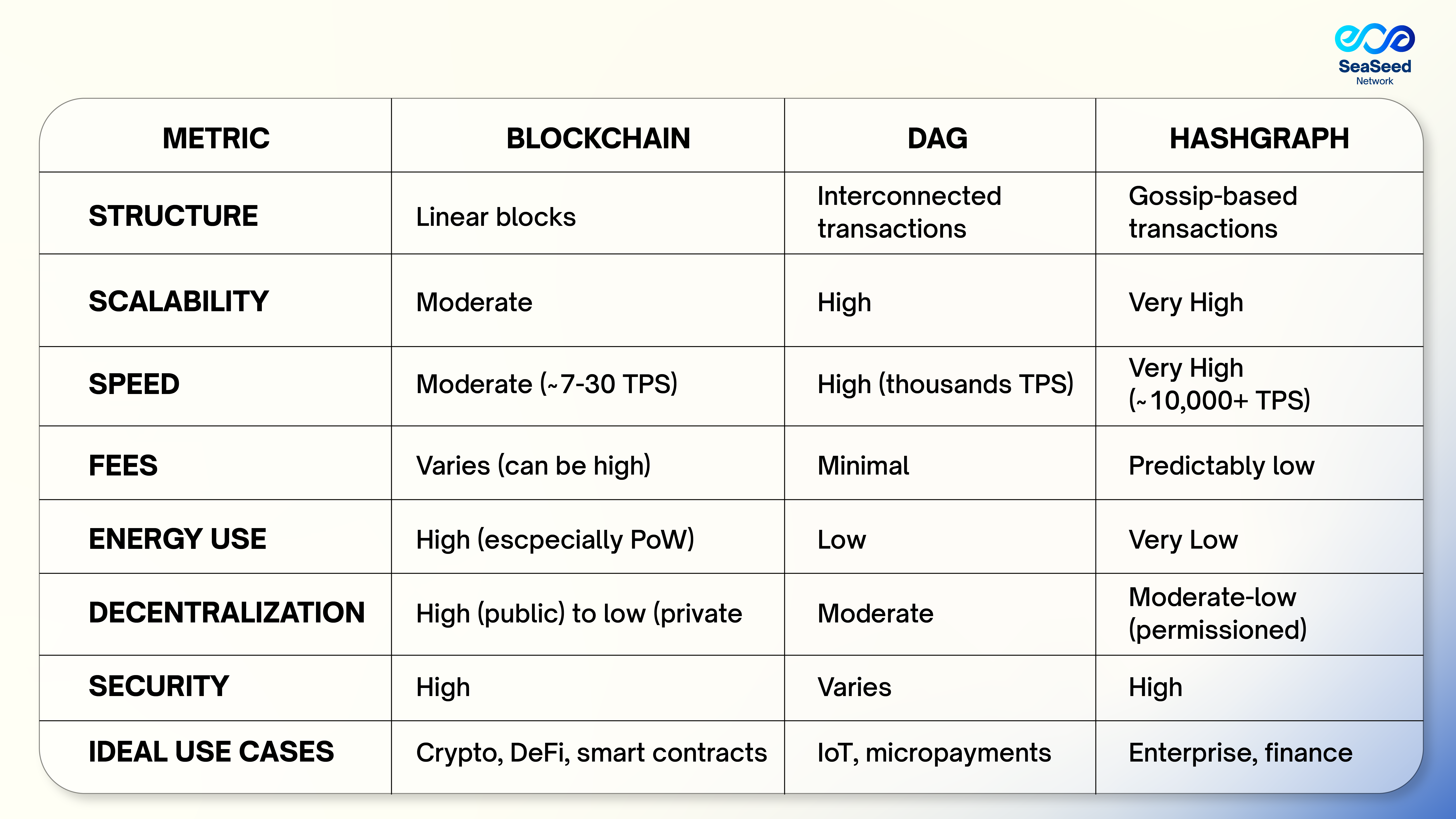

Each model offers a unique trade-off. Blockchain prioritizes security and decentralization, while DAGs, Hashgraph, and Holochain push the boundaries of speed, scalability, and flexibility. Together, they show that distributed ledgers don’t have to look—or behave—like blockchains.

Major DLT Types Comparison Table

SeaSeed Network – A Public Permissioned Blockchain for Institutions

SeaSeed Network stands out as a public permissioned blockchain, specifically built for institutions needing secure, regulated blockchain solutions. It’s open for general use but restricts transaction validation to regulated entities, combining the benefits of decentralization with compliance.

SeaSeed focuses on practical finance applications such as:

- Tokenized Assets: Easily turning traditional financial assets (stocks, bonds, commodities) into digital tokens for easy trading.

- Deposit Tokens: Banks can tokenize customer deposits, enabling faster, blockchain-based settlements.

- Cross-border Payments: Faster, cheaper transactions compared to traditional banking networks.

- Identity Verification: Ensuring users meet regulatory standards directly on-chain.

This approach provides financial institutions a secure, trusted way to adopt blockchain tech without compromising on regulatory standards.

Real-world Adoption & Trends

Blockchain adoption continues to rise. According to Deloitte’s 2024 survey, about 90% of major enterprises now explore or use blockchain, especially for supply chains, finance, and identity verification. The technology has moved from a niche idea to a strategic priority in many organizations, thanks in part to blockchain’s success.

As the Atlantic Council’s CBDC tracker reports, DLT-based Central Bank Digital Currencies (CBDCs) are also gaining traction, with over 100 countries exploring them as digital versions of national currencies. Zippia highlights 81 of the top 100 public companies have dabbled in blockchain tech for their operations or research. Additionally, Boston Consulting Group forecasts tokenization of real-world assets is projected to reach a $600 billion market size by 2030, demonstrating the huge potential of DLT in reshaping traditional finance.

What’s Next for DLT?

DLT’s future lies in greater integration and practical use cases:

- Finance & Tokenization: Seamlessly trading assets, streamlined cross-border payments, and deeper integration between traditional finance and decentralized finance (DeFi).

- Decentralized Identity: Allowing people to securely manage and prove their identities online without relying on centralized databases.

- Enterprise & Supply Chains: Providing immutable records for product traceability, authenticity verification, and collaborative transparency.

Conclusion

DLT is quickly becoming foundational in various industries by providing transparent, secure, and efficient ways to manage digital data. Blockchain led the way, but new technologies like DAG and Hashgraph broaden possibilities for specific needs. Hybrid solutions like SeaSeed Network demonstrate how blockchain can adapt to institutional requirements, blending innovation with regulatory compliance.

As DLT continues to evolve, it promises to fundamentally reshape how we manage finances, verify identities, and collaborate across industries, making our digital lives more secure and transparent.