What is Institutional DeFi?

Institutional DeFi (Decentralized Finance) is an evolution of blockchain-powered finance designed specifically for regulated financial institutions, asset managers, and enterprises. Unlike traditional DeFi, which operates in a permissionless and often unregulated environment, Institutional DeFi combines DeFi’s automation, transparency, and efficiency with the security, compliance, and risk controls of traditional finance (TradFi).

SeaSeed Network is positioning itself as a dedicated RWA (Real-World Asset) Layer 1 and developing a robust Institutional DeFi ecosystem. A critical component of this vision is SeaSeed Network’s new tokenization platform that will play a key role in facilitating institutional-grade asset tokenization and on-chain financial infrastructure.

The Value of Institutional DeFi

Institutional DeFi aims to solve the inefficiencies of traditional finance by leveraging blockchain technology, smart contracts, and tokenized assets while ensuring regulatory compliance and institutional trust. The value of Institutional DeFi lies in:

- Eliminating Intermediaries & Reducing Costs

- Traditional finance relies on custodians, clearinghouses, and brokers, which add time and cost to transactions.

- Institutional DeFi automates these processes using smart contracts, cutting costs and reducing settlement times.

- Enabling 24/7, Borderless Transactions

- Unlike TradFi, which is bound by banking hours and regional regulations, DeFi enables instant, global financial transactions that operate 24/7.

- Enhancing Liquidity in Financial Markets

- Institutional DeFi brings real-world assets (RWAs) on-chain, allowing them to be traded and used as collateral in a more liquid and efficient marketplace.

- Improving Transparency and Auditability

- Blockchain-based finance ensures real-time settlement and on-chain proof of transactions, making financial reporting and risk management more efficient.

How Institutional DeFi Combines the Best of TradFi and DeFi

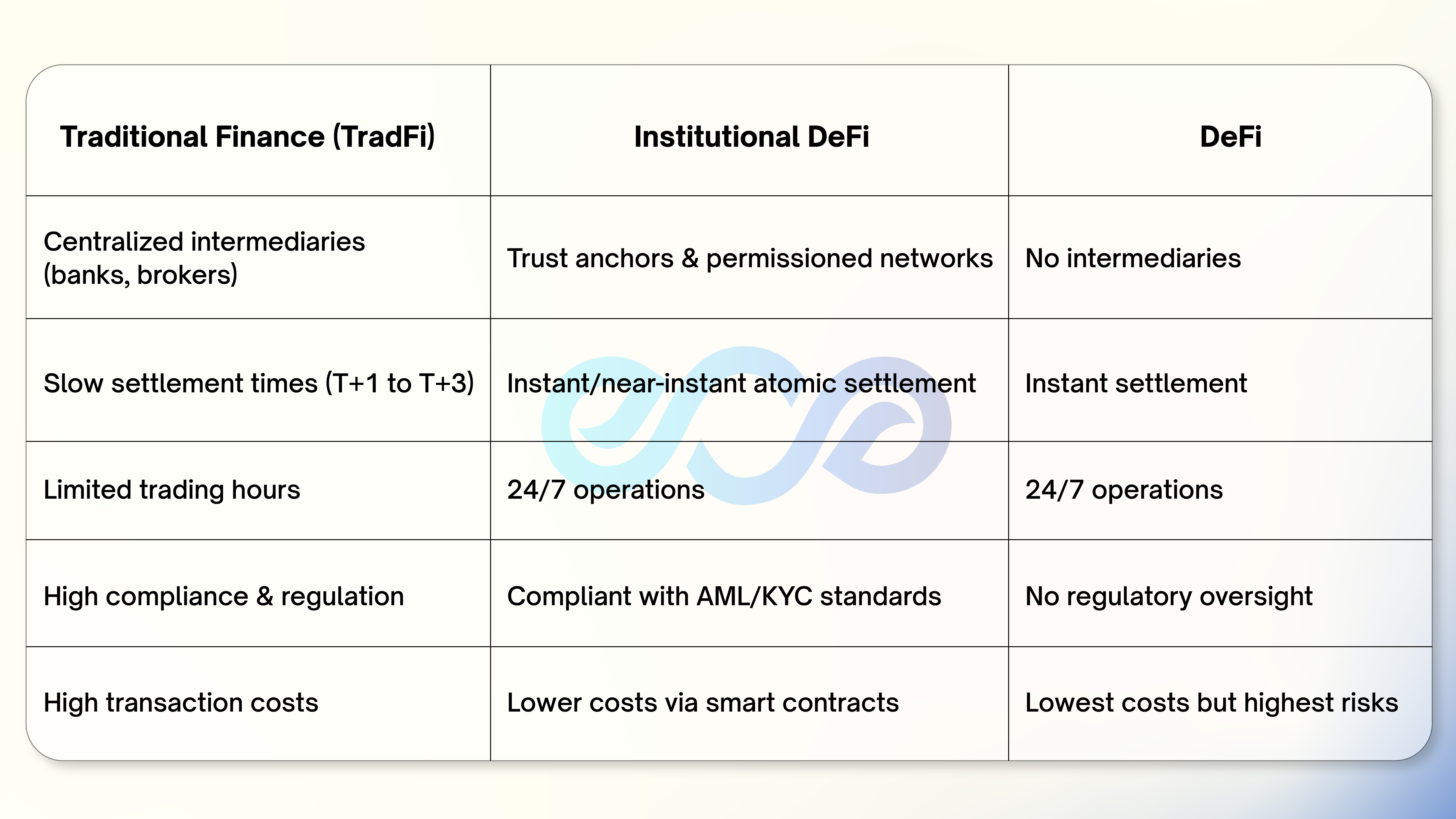

Institutional DeFi acts as a bridge between two worlds, leveraging DeFi’s efficiency while maintaining TradFi’s trust mechanisms. Here’s how:

SeaSeed Network’s Institutional DeFi framework is designed to maximize these advantages. Our powerful tokenization platform enables institutional participants to securely issue, manage, and trade tokenized RWAs while ensuring compliance with financial regulations.

The Key Design Choices for Institutional DeFi: Blockchain, Access, and Tokenization

According to “Institutional DeFi: The Next Generation of Finance?”, a joint report by the Oliver Wyman Forum, DBS, Onyx by J.P. Morgan, and SBI Digital Asset Holdings in 2022, for Institutional DeFi to be scalable and sustainable, financial institutions must make key design choices in blockchain infrastructure, access control, and tokenization models.

1. Blockchain: Public, Private, or Hybrid?

- Public Blockchains (Ethereum, Polygon, etc.): Open and decentralized but lack privacy and compliance controls.

- Private Blockchains: Permissioned networks controlled by a single entity—better for compliance but limited in interoperability and liquidity.

- Hybrid Approach (SeaSeed Network): Combines the best of both—a public permissioned ecosystem within a scalable Layer 1.

- SeaSeed’s Layer 1 design ensures scalability, low fees, and institutional control, while the tokenization platform enables tokenized asset issuance on a compliant blockchain environment.

2. Access: Who Can Participate?

- Permissionless: Open to anyone (like Uniswap, Aave).

- Permissioned: Restricted to verified institutions (like JPM Coin, Onyx).

- SeaSeed Network’s Approach:

- Institutional users will onboard through a regulated framework.

- Participants will use Verifiable Credentials (VCs) for secure KYC/AML-compliant access.

- Our tokenization platform will act as a tokenization gateway for compliant on-chain asset issuance.

3. Tokenization: How Will Assets Be Represented?

- Security Tokens (STOs): Represent equities, bonds, real estate—requiring compliance with securities regulations.

- Stablecoins & Payment Tokens: Represent fiat-pegged assets for settlements.

- NFT-Based RWA Tokens: Represent real-world assets like invoices, fine art, or supply chain assets.

- SeaSeed Network’s Approach:

- Enables issuance of compliant security tokens and RWAs.

- Token management, such as burning of empty-valued RWA tokens and those specified for burning by instructions to optimize asset management

- Our tokenization platform built on ERC 4626 token standard, with key elements such as Vault-based structure and compatibility with other applications, such as launchpad to allow investors to acquire RWA token and earn yield.

- Provides integrated compliance and automated reporting tools.

SeaSeed Network’s Role in Institutional DeFi

Institutional DeFi is reshaping global finance by combining DeFi’s efficiency with TradFi’s security and compliance. However, its success depends on well-designed infrastructure that balances decentralization with regulatory requirements.

SeaSeed Network is building the foundation for the next-generation Institutional DeFi ecosystem, with the tokenization platform playing a central role in bringing tokenized assets on-chain in a secure, regulated environment.

Follow SeaSeed Network to stay ahead in the Institutional DeFi revolution.